Out of these companies, we found that Geico supplied the most affordable non-owner automobile insurance coverage quotes, at 26% much less than the typical annual cost. Contents Least expensive non-owner vehicle insurance policy firms Drivers can anticipate low prices for non-owner car insurance coverage with Geico, based upon the responsibility insurance prices it quoted our Go here profile vehicle driver.

low cost credit money insurance company

low cost credit money insurance company

Selecting State Farm or Progressive over Geico can set you back $285 to $354 more each year. It's totally free, easy as well as protected. We discovered that, the finest non-owner vehicle insurance coverage business for you will heavily depend on where you live, as the insurers prepared to offer this kind of plan in any kind of provided area can differ.

Non-owner vehicle insurance is much cheaper than. In Los Angeles, we approximate that non-owner automobile insurance sets you back $2,565 much less per year than a plan that includes thorough as well as crash coverage.

Non-owner vehicle insurance policy is additionally cheaper than regular plans due to the fact that insurance firms assume you will certainly drive much less frequently and also are much less most likely to sue (affordable auto insurance). One of the concerns insurer normally ask is the variety of miles you intend to drive in a year. Individuals who drive much more commonly go to a higher danger of entering a mishap, creating the insurer to pay for an insurance claim.

Some instances of these insurance firms consist of Direct Insurance coverage, The General Insurance as well as Titan Insurance Coverage. Non-standard car insurance firms specialize in using insurance coverage to risky chauffeurs, as well as those seeking non-owner auto insurance coverage are occasionally taken into consideration high-risk.

Getting The Best Non-owner Car Insurance Companies - Money Under 30 To Work

In addition, non-standard car insurance plan may be the only alternative if you are looking for an SR-22 non-owner automobile insurance policy (car). This is usually the instance for drivers who have actually had their licenses suspended (usually for a DUI), do not possess a car and require an SR-22 filed to obtain their licenses reinstated.

Methodology Insurance prices were approximated based upon the quoted cost of liability coverage and also deducting the regular expense difference for. We tested rates across three cities: Los Angeles, Chicago as well as New York City - cheaper cars.

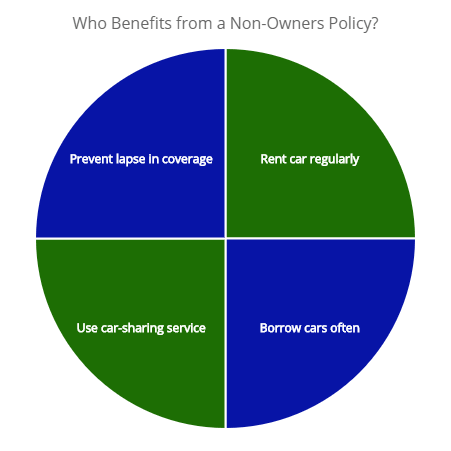

Non-owner plan is cars and truck insurance for non-vehicle owners. This sort of plan covers if you are in a crash while driving someone else's automobile. You need to take into consideration getting non-owner car insurance policy if you obtain or rent out automobiles frequently or if you do not have a vehicle but need to submit an SR-22 form. accident.

Non-owner automobile insurance gives obligation protection to motorists who do not own a cars and truck but still require insurance policy protection. It does not cover any of your injuries or damages to the automobile if you are responsible for an accident. According to Insurance. com's analysis, Geico($311) non-owner auto insurance coverage is the most inexpensive car insurance price, generally.

Non-owner automobile insurance coverage offers liability protection for motorists who need car insurance policy without an automobile. It spends for injuries and also damages you create in a crash when you're driving a cars and truck that someone else owns. Non-owners auto insurance typically enters into play as a second coverage if the automobile proprietor's insurance coverage falls brief in paying for the fixing as well as medical expenses.

A Biased View of Do You Need Auto Insurance If You Don't Own A Car?

For instance, let's state your non-owner's plan has $40,000 in residential or commercial property damage responsibility, and the owner of the automobile you're driving has $20,000 in property damage liability. insurers. You obtain the vehicle as well as cause a crash with $30,000 in damages, leaving $10,000 to be paid by you (or your pal). Your non-owner's policy would cover the extra $10,000 since your restrictions are higher as well as you have protection (cheap car insurance).

If this holds true, your non-owner policy is likely to cost you greater than it would for someone with a tidy document. Drivers may be taken into consideration "risky" if their document includes: A DUI sentence, Negligent driving, Numerous website traffic offenses within a brief time frame, Driving without insurance, If you're seeking certificate reinstatement, your state may need higher liability limitations than it does for others.

In many cases, it may be necessary to submit an SR-22 kind with your state. Filing a non-owners SR22 insurance kind won't contribute to your vehicle insurance coverage expense, however the insurer may charge a (insurance affordable). The complying with table offers example auto-insurance prices for drivers in Southern The golden state. It contrasts as well as gives liability coverage quotes for both a vehicle owner as well as a non-owner.

You desire to contrast quotes zip code from at the very least three insurance policy companies to see that has the cheapest rate. You'll see just how significant providers contrast on quotes for non-owners insurance coverage, as well as that you can save up to $300 by contrast purchasing.

It offers responsibility protection if something occurs and covers you when you are at mistake for causing damage or injury to other individuals. However, it will not offer protection for your very own injuries or damage that strikes the cars and truck you are driving. What does a non-owner automobile insurance plan cover? Responsibility insurance policy covers injuries or residential or commercial property damage that you're legally responsible for as an outcome of a car mishap - affordable car insurance.

More About Your Guide To Non-owner Car Insurance

Non-owner insurance policy does not consist of the following types of protections: Comprehensive, Collision, Towing compensation, Rental repayment, Your non-owner liability insurance coverage can be made use of as additional insurance coverage if you obtain a person's cars and truck and are in a car accident; the automobile proprietor's automobile insurance coverage serves as the key insurance - affordable car insurance.

Additionally, there are a couple of things that non-owner vehicle insurance policy does not secure versus: You will not be covered if you're in a crash that causes damage to the car you take place to be driving at the moment. This means that if you borrow your pal's car and also enter into a minor car accident with an additional automobile, the vehicle's owner can file a case under their own vehicle insurance, or versus the other motorist's cars and truck insurance.

Non-owner vehicle insurance just covers the individual who bought it. If you are using your automobile for work, like supplying plans, non-owners car insurance policy will not cover you (cheapest car).

cheap car insurance credit score car insurance insurance affordable

cheap car insurance credit score car insurance insurance affordable

prices risks risks insure

prices risks risks insure

Some car insurance provider won't allow you to get a non-owner plan if there are way too many primary chauffeurs and also vehicles listed on a plan. If a plan notes 3 vehicle drivers and also three autos, and also you're one of the chauffeurs, you will certainly be detailed as the primary driver on the third car and also will not be able to get non-owner automobile insurance coverage (accident).

Comply with these actions to acquire non-owners insurance coverage, Call a car insurance firm agent about the insurance coverage. If non-owners sr22 insurance is required, offer the agent with your state notice number (if suitable-- not all states require this).

The Greatest Guide To Non-owner Car Insurance: Everything You Need To Know

What is Non-Owner SR-22 Insurance Policy? Non-owner SR-22 insurance is a type of cars and truck insurance policy for motorists who do not have an auto but are required to have SR-22 insurance policy.

What happens if I have non-owner cars and truck insurance policy and I get an auto? If you possess a vehicle, it's vital to buy the right type of insurance coverage - car. A standard automobile policy will certainly cover the damages and injuries you trigger to others. Non-owner vehicle insurance plan do not cover you if you buy an automobile.

Nevertheless, if you drive other individuals's vehicles frequently, it could be a good idea to get non-owner vehicle insurance coverage. Can you rent an auto without insurance coverage? Yes, you can lease an automobile without having automobile insurance coverage. Rental cars and trucks come with some kind of obligation protection that will shield you in instance something goes wrong while driving the automobile.

If you obtain cars sometimes, the owner's insurance must cover you. If you lease autos or drive a person else's automobile regularly, it could be an excellent suggestion to obtain non-owner cars and truck insurance policy.