credit score auto laws insurance companies

credit score auto laws insurance companies

Frequently Asked Concerns Concerning Automobile Insurance Cost Just How Much is Car Insurance for a 25-Year-Old? Depending upon your automobile insurer and also the responsibility coverage you select, a 25-year-old may pay basically than their state's ordinary vehicle insurance policy expense monthly. When you transform 25, you need to call your auto insurer to see if you can save cash on your auto insurance policy rate if you have a good driving history. car insurance.

You will need to hold at the very least the minimum required coverage in case of an accident. You might also opt for added insurance coverage that will certainly enhance your rate, but additionally enhance your defense in the occasion of a mishap.

What Automobiles Have the most affordable Insurance Coverage Rates? When it concerns the typical cars and truck insurance policy cost each month for different kinds of vehicles, vans typically have the least expensive insurance policy premiums. cheaper car insurance. Cars generally have the greatest auto insurance coverage price each month, while sporting activities energy lorries and trucks are valued in between.

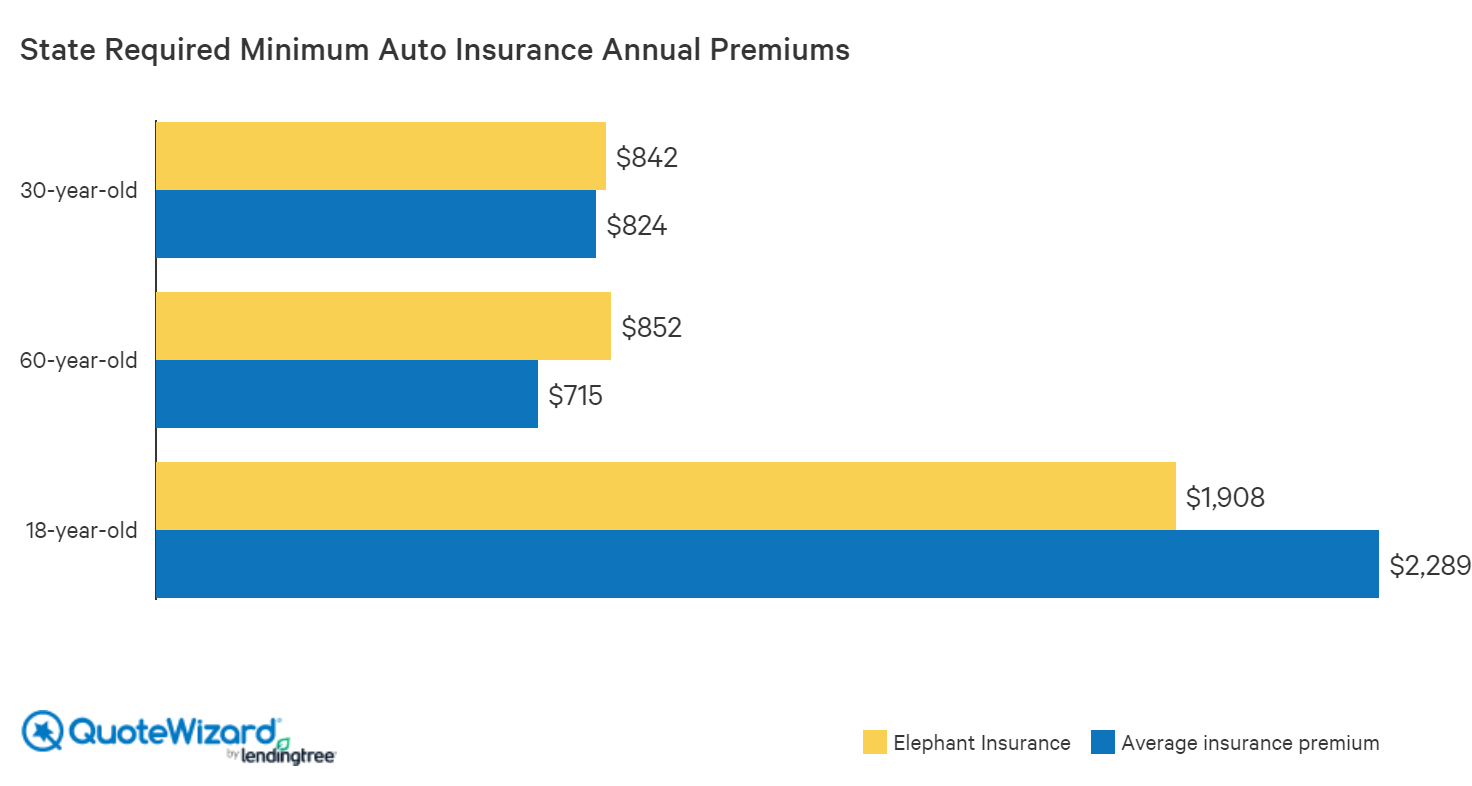

At What Age Is Car Insurance Coverage the Cheapest? Auto insurance costs vary based upon several variables, including age. Vehicle drivers that are under 25 as well as over 60 years old usually pay the most for auto insurance policy. Regardless of your age, if you intend to decrease your auto insurance policy prices, you need to discover an automobile insurance policy firm that can provide you price cuts as well as advantages.

Last Upgraded on November 27, 2020 Having an automobile uses lots of flexibility and also independence for young adults (cheapest). It's very vital for young chauffeurs to have a car insurance coverage plan they can count on. The ordinary price of auto insurance coverage for an 18-year-old driver can be costly, yet there are means that you can keep your costs down.

Just How Much Does Car Insurance Policy Cost for 18-Year-Olds in NY? The average cost of cars and truck insurance coverage for an 18-year-old in New York can be fairly costly. Although these rates sound shocking, recognize that these prices are for 18-year-old chauffeurs by themselves insurance policy plans. Motorists that stay on their moms and dads' plans will pay much less for insurance.

The Best Strategy To Use For How Much Is Car Insurance For 18-year-olds? - Coverage.com

The even more statistically high-risk a chauffeur is, the extra pricey their cars and truck insurance coverage costs will certainly be. Cost can differ extensively relying on who you are, also for young chauffeurs - car insurance. Here Are Several of the Elements That Can Affect Your Vehicle Insurance Policy Premiums:: 18-year-old vehicle drivers who have some experience when driving will likely see a little cheaper costs than all new motorists.

18-year-olds who have currently had insurance for a year may see slightly more affordable costs than those that are obtaining an insurance coverage for the initial time.: Where you are driving can also affect the total cost of your insurance. Car insurance coverage in New york city is currently more than in several various other states for a variety of reasons, consisting of the volume of web traffic in the state's huge city areas.

business insurance auto vehicle insurance insurance companies

business insurance auto vehicle insurance insurance companies

: The kind of auto you have can likewise determine the overall expense of your car insurance coverage - affordable car insurance. Some automobiles are statistically much safer to drive, which indicates that they will certainly have lower premiums. Functions like anti-theft devices can likewise make your cars and truck more secure and also decrease the expense of your insurance generally.

Stats suggest that young vehicle drivers are much more likely to get into accidents because of inexperience and negligent habits. Vehicle insurance provider make up for this added risk by charging more to cover young motorists. The good news is, the ordinary cost of car insurance coverage goes down significantly when vehicle drivers hit their twenties. Policies for those in their early twenties balance between $2,000 as well as $3,000 annually (money).

The initial thing to do is to ask your insurer for a complete checklist of discounts they offer. You could be amazed by what you qualify for. Many firms offer a excellent trainee price cut, which relates to all senior high school and university student with a GPA over a particular degree.

In New York state, all drivers can earn a price cut on their insurance coverage simply by taking one of these short courses. Not only will it help you save cash, yet these training courses can educate young chauffeurs vital skills that will certainly aid them remain safe and also make great decisions on the roadway.

Rumored Buzz on Highway Code To See Major Change To Accommodate Self ...

They are well versed in the market and also will have the ability to aid you discover a plan that takes all of your needs into factor to consider. Discovering the best automobile insurance for a brand-new vehicle driver is so crucial. Although automobile insurance for 18-year-olds in New York can be expensive, searching can help you discover the appropriate plan for your requirements.

cheap cars auto auto insurance

cheap cars auto auto insurance

According to the Centers for Illness Control and also Avoidance, vehicle drivers ages 15 to 19 are 4 times most likely to crash than older motorists, making auto accident the No. 1 reason of death for teenagers. insure. Even teenagers with tidy crash records will certainly deal with high cars and truck insurance policy rates for numerous years because of their lack of driving experience.

, however getting an automobile for the teenager and putting him on his very own plan isn't one of them. The average yearly price priced quote for a teen motorist is $2,267.

Yet the finest way to hold rates down is to make sure your teenager maintains a clean driving record. Adding a teenager to your insurance coverage policy will certainly no question increase your prices, however there are things you can do to balance out the brand-new prices and reduced your automobile costs.

When it comes to teen vehicle drivers and also auto insurance coverage, points get complex-- as well as costly-- swiftly - cheaper car insurance. A parent including a male teen to a plan can anticipate car insurance policy price to balloon to more than $3,000 for complete protection. It's also higher if the teenager has his very own plan.

Now, that we have actually assessed those sobering truths, let's guide you via your car insurance coverage acquiring (affordable auto insurance). We'll consider discounts, choices and also special circumstances-- so you can find the ideal auto insurance policy for teenagers. Even though the appropriate answer is normally to include a teen onto your policy to mitigate a few of the cost, there are various other choices and discounts that can conserve cash.

Some Ideas on How Much Is Car Insurance For An 18-year-old? You Should Know

In the end, you'll require to compare car insurance coverage quotes using our quote comparison device to see which business is best for you. Secret TAKEAWAYSAccording to the government Centers for Disease Control as well as Prevention, the worst age for accidents is 16. If the pupil intends to leave an automobile in the house and also the college is even more than 100 miles away, the university trainee can get a "resident pupil" discount or a student "away" discount rate - liability.

This is called a named exemption. IN THIS ARTICLEHow much is auto insurance for teens? Like we've stated, teen car insurance is costly. The more youthful the chauffeur, the a lot more pricey the auto insurance. Young drivers are even more likely to enter into automobile mishaps than older chauffeurs. The risk is greatest with 16-year-olds, that have an accident price two times as high as 18- as well as 19-year-olds.

A research by the IIHS discovered states with more powerful finished licensing programs had a 30% lower deadly collision price for 15- to 17-year olds. Including a teen to your automobile insurance coverage plan, Adding a teenager to your vehicle insurance plan is the most affordable way to get your teenager guaranteed. It still features a large expense, but you can certainly save if you select the best auto insurance companies for teenagers.

After that we added a 16-year old teen to the plan. Right here's what occurred: The average household's vehicle insurance coverage bill climbed 152%. A teen boy was more pricey. The typical bill increased 176%, compared to 129% for teen girls. California rates enhanced the most, more than 200%. The reason behind the hikes: Teenagers crash at a much greater price than older vehicle drivers.

They have a collision rate two times as high as chauffeurs that are 18- as well as 19-year-olds. Prices differ by insurance coverage firm, which is the reason we recommend purchasing for teen vehicle driver insurance policy.

Simply make sure your teenager isn't driving on a complete certificate without being formally added to your plan or their very own. If my teenager gets a ticket, will it increase my rates?.

Unknown Facts About Car Insurance For Teens Guide

Can a teen obtain their very own automobile insurance plan? State legislations differ when it comes to a teen's ability to sign for insurance.

automobile laws cheaper cars car insurance

automobile laws cheaper cars car insurance

In fact, your teenager will likely have a greater costs contrasted to adding a teen to a moms and dad or guardian policy. There are instances where it could make sense for a teenager to have their own policy. Modern mentions 2: You have a deluxe cars. On a single strategy, all vehicle drivers, including the teen, are insured versus all cars and trucks.

Vehicle insurance coverage is various for a novice car insurance coverage purchaser, however it's a blast to begin a relationship with an insurance coverage carrier. How to reduce adolescent vehicle insurance policy? Teenagers pay even more for car insurance coverage than grown-up chauffeurs because insurance coverage carriers consider them high-risk. There are means teen drivers can conserve on their auto insurance policy premiums.

However, consider versus the reality that young motorists are most likely to get involved in crashes. When you enter an at-fault crash, you have to pay the deductible amount. Increasing your insurance deductible from $500 to $1,000 will lower your yearly costs by approximately $400 - cheaper car. You can also drop extensive and also collision insurance coverage if the automobile isn't funded as well as not worth a lot.

An automobile with a high security score will certainly be more affordable to guarantee. Usage com's listing of vehicle versions to discover the cheapest automobiles to guarantee. This mainly pertains to the cars and truck's expense, how simple it is to repair as well as assert records. also has a checklist of used cars. This isn't truly a popular option for an eager teenager motorist, however it's worth taking into consideration.

Nonetheless, you must likewise recognize the insurance firm still bill greater rates for the very first few years of the permit. Another means to Check out this site lessen your insurance coverage costs is to make use yourself of the discount rates available. Several of them are stated listed below, Discount rates for teen vehicle drivers, We have actually determined the best discount rates for teen vehicle drivers to obtain economical auto insurance.

Our How Much Is Car Insurance For A 18 Year Old PDFs

That's $361 generally. You can take extra vehicle driver education or a protective driving program. This suggests exceed as well as past the minimal state-mandated vehicle drivers' education and learning as well as training. In some states, discounts can run from 10% to 15% for taking a state-approved driver improvement course. Online courses are a convenient choice yet talk to your service provider initially to make certain it will certainly bring about a discount.

You could get a price cut around 5% to 10% of the student's premium, however some insurance providers promote up the 30% off. The ordinary student away at institution discount is more than 14%, which is a savings of $404. Maintain a tidy document and you can obtain a discount. This implies you do not enter into any accidents or violations.